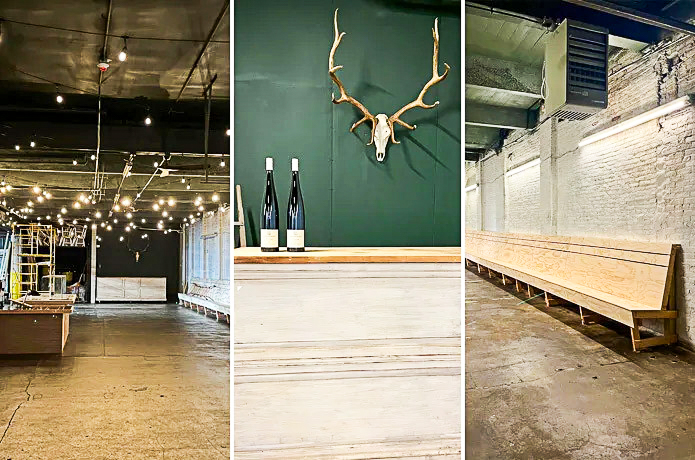

In a typical semester, as lunch hour arrives, nearly 50 Lafayette students congregate in the basement of the Simon Economics Center every Friday to discuss stocks and bonds over pizza.

These are the members of the Lafayette College Investment Club, the oldest student-run investment club in the US. Started in 1945 with a seed funding of $3000 provided by World War II veteran and Lafayette alumni J.H Tarbell, the club has crested $1 million earlier this spring in their portfolio.

According to the club’s website, their portfolio currently consists of a variety of securities, a majority of which are equity-based. These include domestic stocks, mutual funds, international investments and bonds. Part of their portfolio is designated as cash holdings, which are used to buy new assets and fund their annual trips.

The club meets every Friday to discuss their portfolio, updates on the current financial market and future job, and internship opportunities in the field. Meetings also include pitches by students on where to invest and educational presentations by guest speakers on careers in the finance industry. The club also discusses whether to buy or sell securities, which is then voted on by other members.

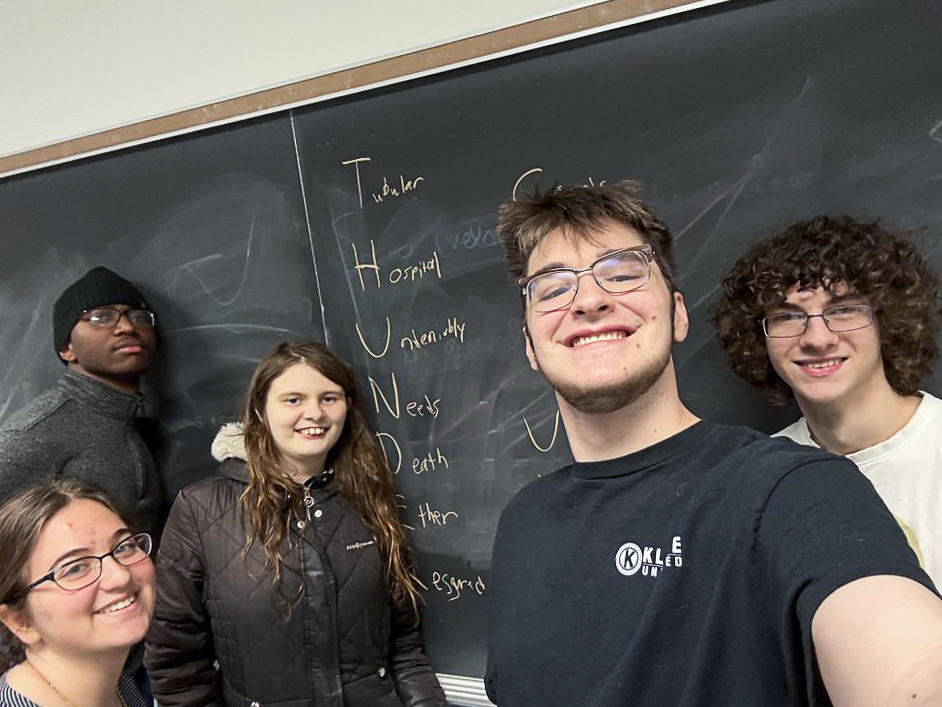

“It’s a purely educational club…It’s open to anyone with any level of knowledge. You can know nothing about finance, stocks and you’re welcome to join,” said Tergel Khatanbaatar ’21, head analyst of the club.

Elaborating on the club’s strong alumni network, Khatanbaatar said, “We have so many great alumni, Lafayette alumni, investment club alumni, that want to give back to the students, the club members. So, they always come back…do talks, help us understand what’s their role, how they got into that role, what they did on a day-to-day basis. We have had some really great alumni from a lot of big banks.”

Last semester, the club welcomed Mervin Burton, the Director of Investments for the Lafayette College Investment Office, to discuss his career journey and how the school’s endowment is managed.

Additionally, in an effort to give its members real-life exposure to the financial world, the club takes annual trips to Wall Street, visits banks and hosts discussions with alumni in New York City.

However, the members of the club are not just interested in making profits—they are also committed to maintaining sustainability in the field by focusing on Environmental, Social and Corporate Governance (ESG) friendly companies.

The club’s website states that, “The Club believes that with its substantial capital position, and the rapidly growing opportunities to invest in ESG friendly companies, there is no justification for sacrificing morally just practices for profits.”

And in the future, Khatanbaatar said that the club seeks to become more inclusive and increase their outreach to everyone on campus.