Sustainability Committee calls for more transparency over endowment investments

The Sustainability Committee sent out flyers to clubs and organizations on campus to discuss which industries in which they would like the school to invest their endowments funds. (Photo by Emma Sylvester ’25 for The Lafayette)

February 25, 2022

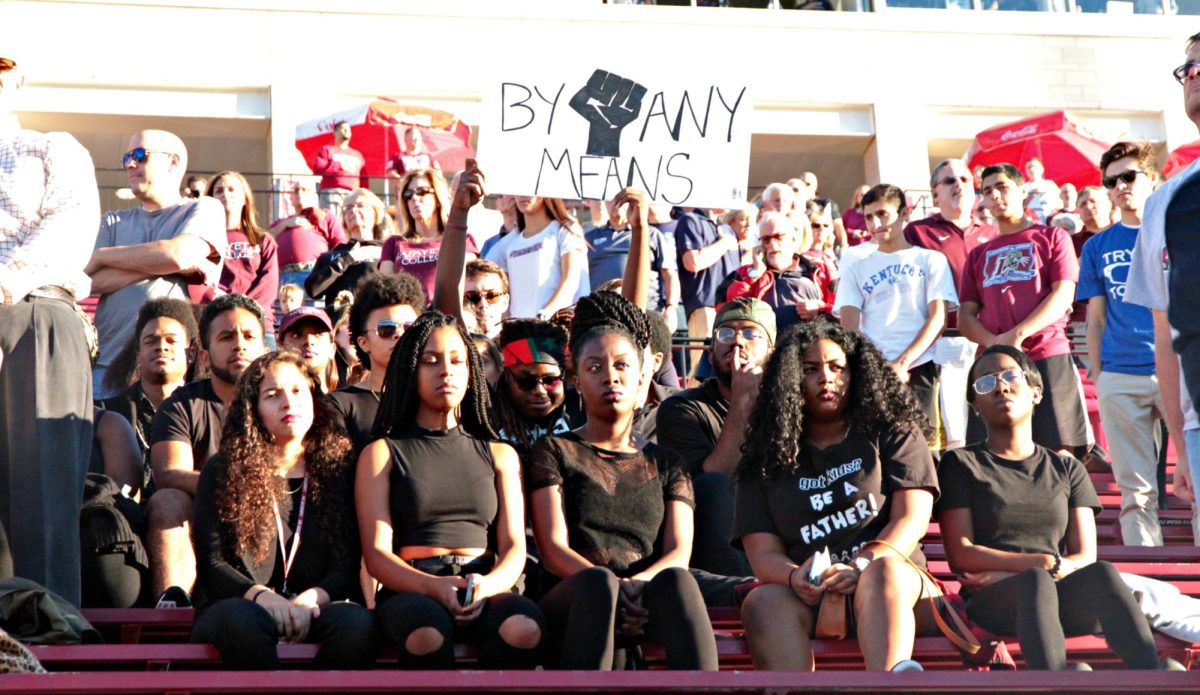

In 2019, students rushed the field of the Harvard-Yale football game in protest of their schools’ endowment investments in the fossil fuel industry. The demonstration acted as a catalyst for Harvard to pledge to divest all their fossil fuel assets by the end of 2021. When Remy Oktay ’23, a member of the Student Government’s Sustainability Committee heard about this accomplishment, he went to his fellow committee members with a question: Why not ask the same thing of Lafayette?

Sustainability is listed as one of the three core values of the college listed on its website. The Association for the Advancement of Sustainability in Higher Education (AASHE) ranked Lafayette in the top 10 for the food and dining sustainability category for the LaFarm initiative in its the 2020 Sustainable Campus Index. To the Sustainability Committee, however, endowment funds are an opportunity to improve the environmental impact beyond just what is happening on campus.

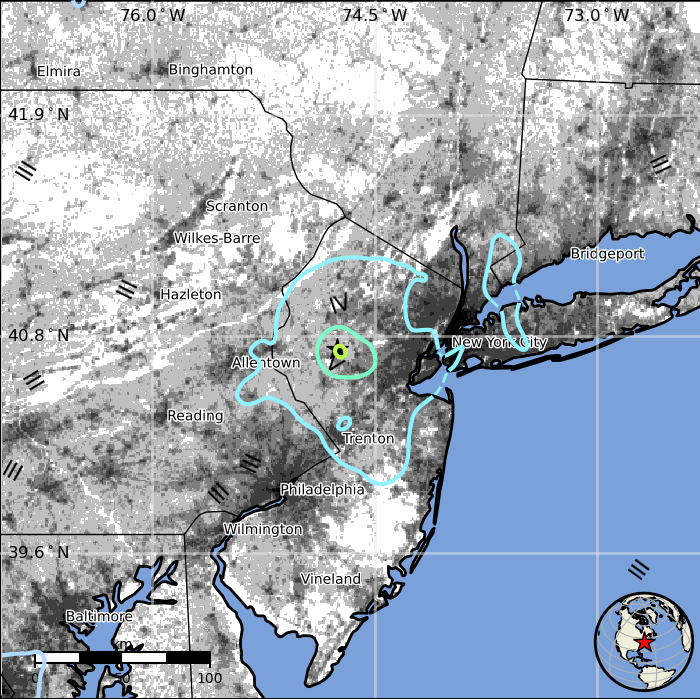

Following a loss due to Covid market volatility, Lafayette’s endowment has bounced back heavily this year, passing one billion dollars. This new figure places Lafayette among the top 10% of American colleges and universities in endowment per student.

According to the Sustainability Committee, the effect of investing more funds with environmentally and socially conscious companies could be massive for both Lafayette and the larger community.

Private universities are not subject to open-record laws, meaning they are not under any obligation to disclose their investments. In Lafayette’s case, the way the endowment is spent is not entirely tracked by the administration. According to Krishna Memani, the chief investment officer of the college, the Investment Office does not have a complete analysis of the endowment’s holdings by industry.

“I am a big supporter of ESG policies in general,” Memani said. “While we have minimal investments—less than two percent—in fossil fuel oriented investments at the endowment, at the moment, we do not include ESG guidelines in our investment decision-making process.”

Oktay, along with other members of the Sustainability Committee, would like to have more clarity on where Lafayette’s endowment is currently making investments. Furthermore, the committee would like the members of the Lafayette community to have a voice regarding which industries the money is invested in the future.

“Students, faculty, staff, alumni, everybody who’s part of the bill should be able to say, ‘hey, this is how we think our money should be invested,'” Oktay said. “And that should be representative of all our voices.”

Going forward, the Sustainability Committee is set to make new headway on their initiative. Last week, they sent out flyers to clubs and organizations on campus to discuss which industries in which they would like the school to invest their endowments funds. Additionally, they will be collaborating with the newly created sustainability affinity group, which is a collection of alumni and faculty focused on connecting students to sustainability-based jobs.

Memani noted that the school’s Investment Committee is making their own efforts to collaborate with students, alumni and faculty on financial decisions. In particular, the Board of Trustees has sought to include Environmental, Social and Governance Policy (ESG) for future investments.

“The Investment Committee of the Board of Trustees had a robust discussion on the topic last year, and we laid out a roadmap for incorporating ESG policies in our investment decisions,” Memani said. “As a first step, the Investment Committee asked the full [Board of Trustees] to initiate a campus-wide conversation to arrive at specific objectives with respect to ESG in general and its implications for endowment investments.”

Beyond the sustainability or investment committees, some students are thrilled their voices can have a direct outlet to the school’s investment decision-making. Sarah Cohen ’24 expressed how excited she was at the ability to be involved with the endowment.

“One of our responsibilities as a school with such a large endowment, especially with respect to the size of our student body, is to use it to the fullest potential to maximize the good that we can do,” Cohen said. “It’s important to uphold our institutional values beyond the classroom and beyond what we put on pamphlets and really put into action. We should put our money where our mouth is.”

Disclaimer: Editor-in-Chief Lucie Lagodich ’22 is the director of the Student Government Sustainability Committee and did not contribute writing or reporting to this article.