The United States House of Representatives has released the proposed “Tax Cuts and Jobs Act,” which would require private universities with assets of more than $100,000 per student to pay a 1.4 percent excise tax on their net investment income, Business Insider reported.

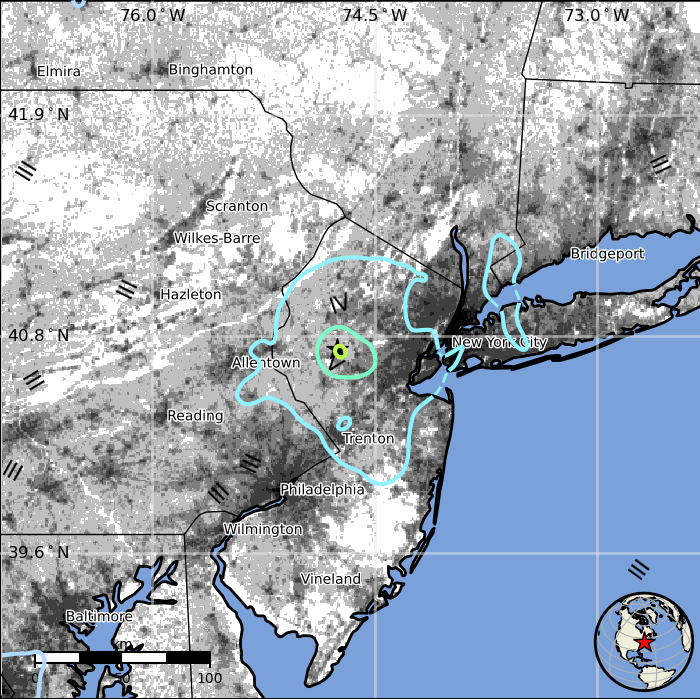

Lafayette’s current endowment is $810 million, and enrollment is around 2500 students. This breaks down to about $319,000 per student. In comparison, Lehigh University’s endowment is about $1.3 billion which breaks down to about $170,000 per student.

The proposed endowment tax could directly affect both the operational budget of Lafayette College and its fundraising efforts, Vice President of Finance Roger Demareski said.

Since the college is subject to what happens in Washington, they are trying to exert any political influence they can.

“We’re trying to have influence through our state and federal representatives to the lawmakers. Lafayette is very strong financially, so while this would be an impact, if it unfortunately did happen, I think we could manage that impact,” Demareski said.

As a result of the tax, Demareski said the college could be affected in a few possible ways.

First, the tax would lead to additional pressures on the college’s operating budget. Five percent of the endowment currently supports the operating budget for the college, which makes up for the difference between what the college receives from tuition payments and what it takes to run the school.

As a result, Demareski said, the endowment tax may lead the college to reduce expenses somewhere in the operating budget.

In addition, the school is currently able to borrow funds when they issue tax-exempt debt, which means the investor doesn’t pay tax on their return. If the proposal is passed, the college would no longer be able to pass tax-exempt bonds.

Demareski said the proposed tax also has the potential to hurt fundraising efforts. Donations to the college would no longer qualify for tax-deductions, which could decrease incentive to donate and affect the college’s annual fund.

President Alison Byerly also noted the potential negative effects of this endowment tax for the college, especially in relation to financial aid and tuition.

“Lafayette’s endowment provides crucial support to our annual operating budget. It is an important source of funding for financial aid in particular. The proposed endowment tax will reduce the funds available for scholarships, to support academic programming, and other purposes. The effect will be either to reduce our capacity in these areas, or require us to make up the difference with tuition dollars,” Byerly wrote in an email.

Demareski said that while the tax could affect financial aid funding, the college would still maintain its efforts to achieve need-blindness.

“[We would] stay on track for our plan to become need-blind. It may take longer for the plan, or we may have impacts to other parts of the operating budget,” Demareski said. “Either way there would be an impact.”

Additionally, Demareski said the tax could put pressure on universities to raise tuition, but he doesn’t know if that would happen at Lafayette.