From Student Government initiatives to improve the college’s investment policies to the Investment Club’s restructuring of its own portfolio, the topic of sustainable investing has become a hot topic on College Hill. While Lafayette has made strides in the fight against climate change, its own investment portfolio does not reflect that commitment.

Using data produced by the Association of the Advancement of Sustainability in Higher Education (AASHE), Lafayette students in a Sustainable Solutions class in 2015 found that Lafayette underperformed in terms of investing with companies or businesses known for “exemplary sustainability performance.”

“This is not to say that Lafayette does not put their endowment money to great use,” the report read. “However, we fall short in this category because the college does not promote positive sustainable investment strategies.”

Data from the Sustainability Tracking, Assessment and Rating System produced by the AASHE in March 2020 designated Lafayette at its silver level. This put it on par with schools including Tufts, Lehigh and Yale University.

Lafayette’s Chief Investment Officer Krishna Memani confirmed these findings.

“Lafayette College has made sustainability and inclusion policies an integral part of its mission. However, at present, Lafayette endowment investment policies, as codified in the Endowment Investment Policy Statement (IPS), do not have any specified objectives or implementation guidelines with respect to sustainability and inclusion,” Memani said.

Memani added that the Board of Trustees would have to determine the “goals and objectives for such policies” given the fiduciary responsibilities of the Investment Office, which would require a deeper conversation with the entire Lafayette community.

“In such a conversation…it may be easier to arrive at simple and tangible sustainability goals. For example, excluding fossil fuel producers from the investment portfolio–such a linear and incremental approach will be a missed opportunity, especially in light of a broader set of choices on the sustainability front,” Memani said.

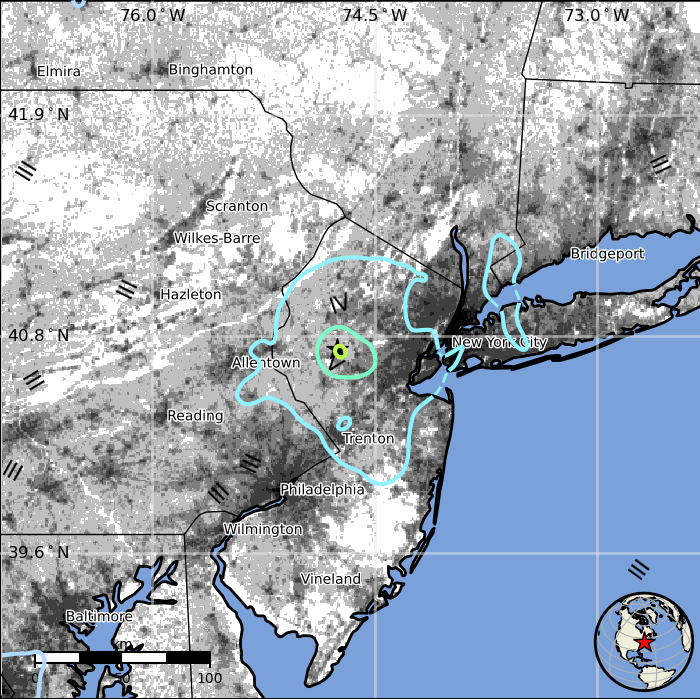

Despite the college’s investment decisions, Lafayette is still working towards a greener future. The Climate Action Plan 2.0 established the goal of carbon neutrality by 2035. This plan includes the creation of a “green revolving fund” that will reduce the college’s environmental impact and operational costs while being invested in renewable energies like solar power. In 2020, the college announced that it had signed a 15-year virtual power purchase agreement to buy renewable energy generated from a Texas solar farm.

Remy Oktay ‘23, a representative on the Student Government’s Sustainability Committee, applauded the decisions but noted that more work could be done.

“Every step in that direction is good, but I think that we can never do enough,” he said.

Students taking issue with their college’s investment in fossil fuels extends beyond Lafayette. Following the delay of a Harvard-Yale football game in 2019 by students who rushed the field in protest of their schools’ investment portfolios, Harvard announced its decision to “allow its remaining investments in the fossil fuel industry to expire” in 2021.

Students at Lehigh University also took issue with their school’s investment in fossil fuels. Protests in 2015 led to a discussion of the topic at a meeting in 2018. That same year, Lehigh had two percent of their endowment invested in fossil fuels, a similar proportion to Lafayette.

In 2018, the former Chief Investments Officer Joseph Bohrer said that one percent of Lafayette’s 830 million dollar endowment was invested in Fossil Fuels. Memani confirmed that number is accurate for the college’s current endowment of just over a billion dollars, saying that it “rounds up to roughly one percent,” which would be around ten million dollars.

Unlike Lafayette’s investments, the student Investment Club is committed to using environmental, social and corporate governance (ESG) guidelines for their portfolio. This means that they support companies who have measures in place to combat the climate crisis and that avoid depleting the already diminishing raw materials in the world, according to a statement from the club released earlier this year.

Nick Tufano ‘22, the club’s treasurer, initially pushed for the club to adopt ESG standards after seeing other asset managers do the same.

“Everyone thinks about [ESG] as just sustainability. That’s certainly a large part of it, but it also talks about social rights and corporate governance. How much are you paying your employees, relative to your executive board? How is the company structured? It talks about a lot of those issues, it’s a really holistic view of analyzing a company, aside from just financial metrics,” Tufano said.

Co-president Jack Evans ‘22 noted that investing in these companies brings generous returns, too.

“We’re a long-term club. We’re looking at companies that are going to be profitable in the future, and those are typically sustainable companies,” Evans said.

Evans and Tufano said that there was little social pressure to adopt these measures, but they considered the reputational benefits of supporting sustainable companies.

“It was realized as a club…it’s time for the portfolio to look at sustainable options,” Evans said.

“Part of my push for it was if we want to tout that we’re the nation’s oldest student-run investment club and we want to be proud of our one million dollar portfolio, when an initiative like this comes up, we should be on the forefront of it,” Tufano said.

The Student Government Sustainability Committee is also working on an initiative to encourage the college to adopt new sustainability metrics in its investments. Oktay said that one of their main goals is to “meet with the endowment office and understand where our investments currently lay so that we can be proud of where this money is coming from.”

Tufano added that the college has an opportunity to set itself apart by being on the leading end of this push for sustainable investments.

“Lafayette likes to tout that they’re an elite liberal arts college and an elite academic institution and if they want to do that, they should get in on it before it becomes a point where they’re being socially pressured,” Tufano said.

“Lafayette has an ethical responsibility to align their investments with the values of the school, with their mission statement, with the core value of sustainability,” Oktay said.