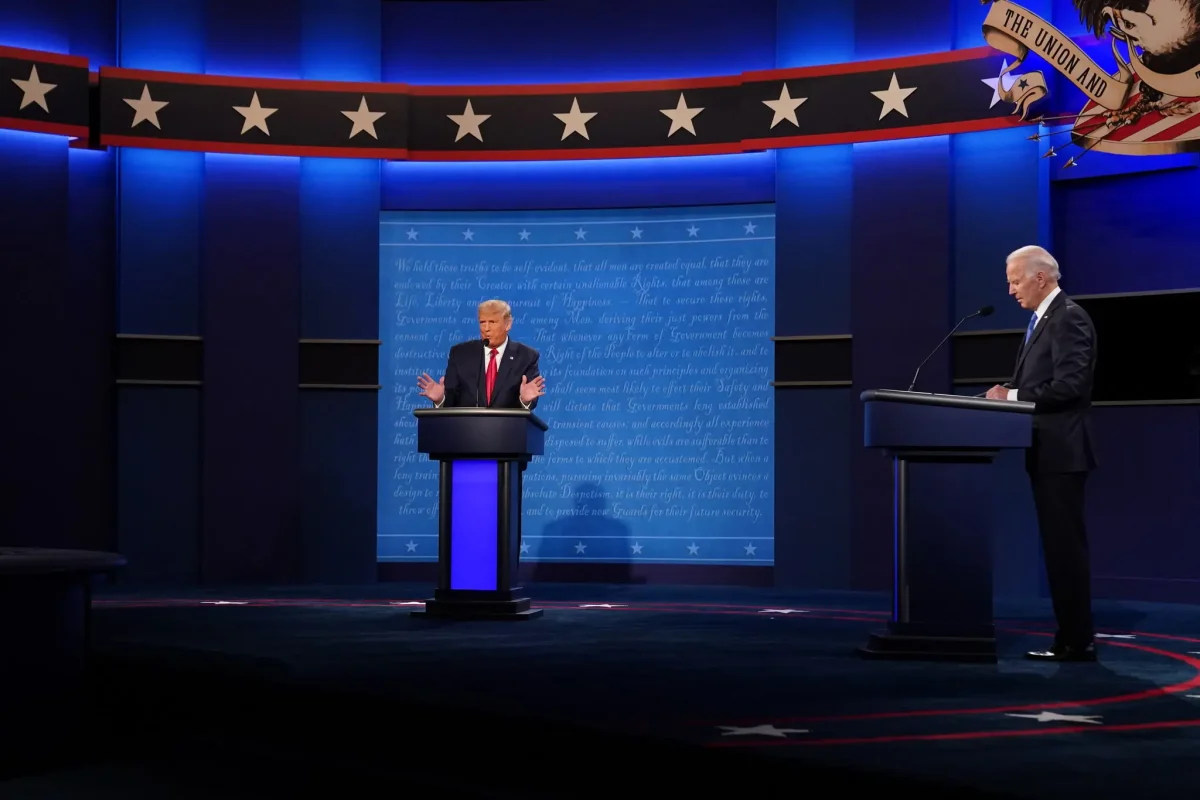

On Aug. 24, President Joe Biden announced his plan to reduce debt for countless current and former college students who utilized federal loans. The new program has been met with mixed reactions from experts, everyday citizens and politicians across the political spectrum.

The new program would, among other policies, cancel up to $20,000 for students whose income falls below a $125,000 income threshold. For college students who meet the income threshold without earning a Pell Grant, the debt relief is still $10,000. In addition, students utilizing payments would be required to spend no more than five percent of their monthly discretionary income on loans, a reduction from the prior 10 percent. Loan balances for those with $12,000 or less in balances will be forgiven after 10 years rather than 20 years. Borrowers currently employed by non-profits, the military or the government on a local, tribal, state or federal level may be eligible to have all of their loans forgiven through the Public Service Loan Forgiveness Program up through Oct. 31, 2022.

Reactions to this monumental new policy, which could affect up to 43 million borrowers, were divided. Some Democratic politicians and other left-leaning individuals praised the bill, with Senator Elizabeth Warren, D-Mass., calling it “historic” in an interview with USA Today.

“This is America saying that our people, even people who don’t have a lot of money, are an investment,” Warren said. “We’re just going to keep on investing.”

However, many Republican politicians, and even several Democratic officials, voiced their displeasure with the new federal policy. Lisa Scheller, the Republican candidate for Pennsylvania’s 7th Congressional District, of which Lafayette College is a part, wrote on Twitter that the program would work to the benefit of the wealthy.

“Joe Biden announced that PA working families will be forced to pay off the debts of doctorate degree elites. Whether it be gas, groceries, or taxes to subsidize those making 6 figure salaries, our working families are paying more and can’t afford the Biden-Wild agenda,” Scheller wrote.

A spokesman for Scheller sent an identical statement in an email.

Democratic Rep. Susan Wild (PA-7), whom Scheller is challenging, wrote in an email that forgiving student loans would not remedy “predatory interest rates, compounding of interest, and unnecessarily complicated loan structures,” pointing to her Simplifying Student Loans Act as a better solution for relief. According to an Aug. 9, 2022 press release, the Simplifying Student Loans Act proposes a restructuring of the federal student loan repayment system.

Deja Jackson ’23 had a similar tone to that of Wild.

“I think it’s better that we address the new issue of affordability of college rather than cancel student debt,” Jackson wrote in an email.

Despite some negative views on the impact of the new student debt forgiveness plan, at least one study has shown that debt forgiveness will have little effect on the national economy. According to one Goldman Sachs study, President Biden’s debt forgiveness plan, which in total would discharge about $400 billion in student loan balances and other monthly payments, would only have a “small” effect on both government spending as well as on inflation.

Economics Professor Amy Guisinger wrote in an email that while inflation is one of the most dire issues current affecting the Federal Reserve, recent events would lessen the immediate impact on the American economy’s inflation caused by the new federal debt relief.

“Because of the student loan pause (one of the COVID relief efforts), many people are not currently making loan payments, which means the immediate effect on inflation would be small,” Guisinger wrote. “It is possible that the medium-term effects could also be minimal, as the program is forgiveness of a loan that would have been paid out over many years rather than an immediate injection of cash (like the stimulus checks).”

Under the new plan, the pause on federal student loan payments has been extended to Dec. 31, 2022. This will be the seventh and final extension of the student loan payment pause since it was implemented under former President Donald Trump.

Trebor Maitin ’24 contributed to reporting.

Editor’s note 9/2/2022: A previous version of this article stated that a spokesman for Scheller did not respond to a request for comment. This article has been updated to reflect that a response was emailed, albeit not in time for publication.