Student Government passed a resolution last week aimed at increasing transparency from the college regarding the college’s endowment. The goal, as stated in the resolution, was to “align the college’s mission statement…with the endowment investment policy.”

While the college’s mission statement does not mention the topic, sustainability is one of Lafayette’s three core values.

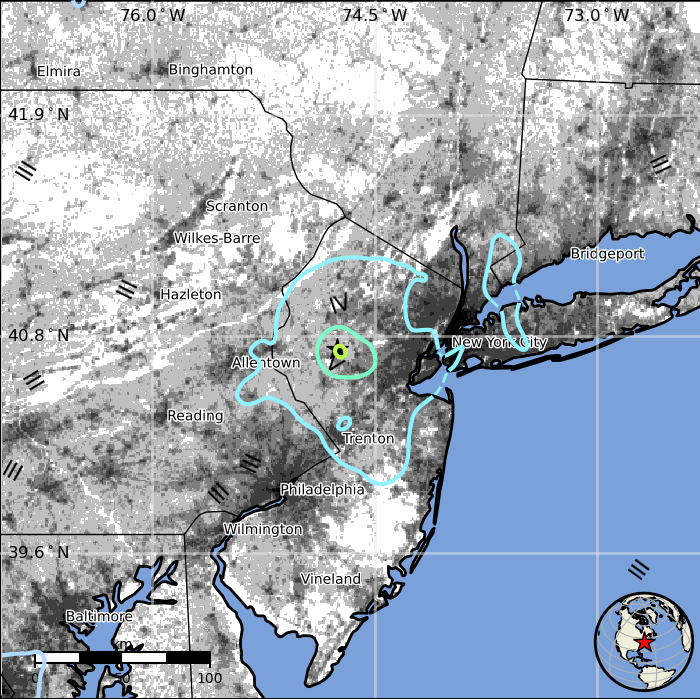

The resolution encourages Lafayette to uphold its ethos of sustainability and its Climate Action Plan 2.0 in its endowment and endorses a recently established, student-run “Lafayette College Endowment Coalition.” It also notes that a greener portfolio would place Lafayette ahead of peer institutions in the Lehigh Valley Association of Independent College’s (LVAIC ) and Patriot League and on footing with institutions like Harvard and Yale when it comes to implementing sustainable investment policies. This initiative was spearheaded by members of Student Government’s Sustainability Committee, including Remy Oktay ’24.

Oktay will be drafting a letter to the Board of Trustees with his fellow committee members to invite further conversation.

“This definitely has the potential to be really, really impactful,” Oktay said.

The resolution follows a sustained interest in cultivating more transparent communication surrounding the endowment portfolio among members of Student Government and beyond. The resolution also comes after the college’s endowment swelled to over one billion dollars last spring. Materials sent to students and professors in the Endowment Coalition before its second meeting elaborated on the function of endowments like Lafayette’s.

Endowments, according to an article shared with the members of the coalition, may generally be described as assets set aside so that the original assets, known as the “corpus,” grows over time from income earned from interest on the underlying invested funds

One linked article describes: “Endowments may generally be described as assets (usually cash accounts that are invested in equities or bonds, or other investment vehicles) set aside so that the original assets (known as the “corpus”) grow over time as a result of income earned from interest on the underlying invested funds.”

Institutions that often make use of endowments, like hospitals and universities, tend to keep a “principal corpus” intact to grow over time, but use annual investment income “for programs, or operations, or purposes specified by the donor(s) to the endowment,” the article stated. Information about restricted endowment funds for donors is available on the Lafayette website, which specifies that named endowed funds beginning at $10,000 can be donated to support specific student scholarships.

However, little other information regarding the endowment is available online. As a private university, Lafayette is not subject to open-record laws and is thus under no obligation to disclose its investments.

Matt Tadesse ’24, Student Government president-elect, said that the resolution seeks to address this lack of information.

“The core problem was that there was no transparency in terms of having a clear understanding on the things that we were investing as a college and that was an issue because we don’t know whether we’re investing in gas,” Tadesse said.

Last semester, The Lafayette reported that about one percent of the college’s investments are in fossil fuels. The article estimated this to be around ten million dollars. Tadesse said that one difficult aspect of making such information public is the structure of the institutions which aid Lafayette’s Investment Office in managing the endowment, such as hedge funds.

“When you make an investment specifically with hedge funds, they don’t specifically tell you what they’re investing in, because if they do, then you could just go ahead and do it yourself. But they give you a general sense of the things that they invest in,” Tadesse said. “So what we were hoping to get was not individual companies that they invest [in]…but more so the kind of…sectors that they invest in.”

Oktay described the vast potential for engagement presented in cultivating new priorities for the school’s endowment.

“We’re really only now focused on how can we get the best returns and reduce risk for Lafayette College,” he said. “But there’s engaging both with the companies that we’re invested with, and then engaging with the community through the Endowment Coalition.”

Oktay said that beyond divestment, he hopes that Lafayette might be able to turn to the companies in which it invests as a major shareholder to express the principles of its own mission statement and to redirect theirs.

“There’s so many other realms that money can do a lot of good [when] we look at our money as a tool for change,” Oktay said.

However, as Tadesse also noted, this work will take time. Abigail Warrender ’25, a member of the Student Government sustainability committee, detailed the importance of the resolution.

“The resolution is important because it is an official document that signals to the College that students want to see our endowment invested [in] a more socially responsible manner,” Warrender said. “It holds more sway than just communicating this to the college through, say, an email.”

Warrender added that the resolution is just a first step.

“The school does not technically have to change their endowment just because we created a resolution. It will take numerous meetings, the involvement of alumni and the Board of Trustees, and greater student support, to see genuine change with the Endowment, and we anticipate all of this beginning in the fall semester,” she said.

Disclaimer: Editor-in-Chief Lucie Lagodich ‘22 is Sustainability Director of Student Government, and assistant news editor Trebor Maitin ‘24 is a member of the Public Relations and Marketing Committee. Neither contributed writing or editing to this article.